Too many choices. We have an explosion of choices in places to put money for investment purposes. There are a dizzying array of choices among Exchange Traded Funds, Mutual Funds, Corporate Bonds, Municipal Bonds and companies. Sadly, just putting money into one or more of these instruments is no guarantee of success and has a high probability of little or negative return (i.e. loss). So, how can an investor manage these choices and harness all this competition?

| Competition is great. Beyond ETFs starts with rank-ordering the potential universe of possible investments on the basis of their Price Momentum. Research has shown that a stock’s price is likely to continue to increase for the next 6-12 months if it has been increasing for the past 6-12 months and similarly a stock’s price is likely to continue to decline in the next 6-12 months if it has been declining for the past 6-12 months. We assign a Price Momentum value to each of the stocks in the ‘universe’ with each analysis, and invest in only the highest ranked by Price Momentum stocks. With Beyond ETFs you make those companies compete for your limited investment dollars. |

Uneven Quality. Just because a mutual fund, an ETF or stock has done well in the past year, three years or five years doesn’t mean that it will be a good investment for the next five years. In other words and I’m sure you’ve heard this before, ‘past performance, is no guarantee of future success.’ How can an investor stay focused on the quality opportunities and stay away from the duds?

| Instead of arbitrarily choosing stocks to be in the universe or out of the universe, Beyond ETFs chose the S&P 100 index. This gives us two important things. Firstly, the companies in the S&P 100 index are the largest capitalized companies in America. They are name brand enterprises, every single one. They are also among the most-well-run companies in the world. No fly-by-nighters here.

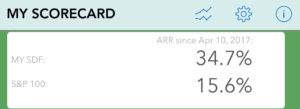

The second thing this selection gives us is a benchmark to compare against. The scorecard feature of Beyond ETFs compares our simulator or your own portfolio against the S&P Index. So, you always know the score. My scorecard is showning an annual rate of return of 34.7% versus the Index of 15.6%. That’s because I’ve concentrated my investments into the top Price Momentum players (a.k.a. Buy* zone), while the S&P 100 Index includes many low performers (GE, Phillip Morris are both low performers at the moment) which are in the Avoid zone. |

Low Integrity. Research shows that in fund management, success breeds mediocrity. It’s been proven that as fund managers earn credibility and investors respond by buying into that fund, the performance of the fund suffers. Name-brand publishers write shrill marketing fluff encouraging FOMO (Fear Of Missing Out) for high risk initiatives in crypto-currencies, marijuana retailers and .. surprise, their own ETF. How can an investor discover and trust a process that systematically showcases potential opportunities?

| Consider The Brockmann Method as a process that has been proven to work, not all the time, but over time. This process is imbedded into Beyond ETFs to provide the knowledge necessary to know what to Buy* and when to Sell*. The app includes the ‘Coulda’ Calculator’ so that you can see what you could-have-made from any time over the past decade, if only you had decided to subscribe earlier.

Subscribers buy one or more stocks in the BUY* zone. This listing of ten stocks have the highest Price Momentum. Over time, as those securities compete with other firms, they may eventually fall below the 25th ranking. This is the Sell* threshold and signals that the stock should be sold. The app automatically indicates that a stock the subscriber owns is now in the Avoid zone (below the 25th position). Subscribers sell and use the proceeds to purchase the next highest ranked stock they don’t already own. |

You Deserve Better.

At the end of the day, you are the only person responsible for your investment success.

At the end of the day, you are the only person responsible for your investment success.

It is possible that your scorecard could look like mine on the left (or even better). For folks who realize that simple fact, but want to beat the Index, creating their own Self-Directed Fund is an important step. The app, Beyond ETFs codifies the Brockmann Method and guides the subscriber by providing the knowledge of when to Sell*, and what to Buy*.

It has worked for me. It could work for you. Only you will know for sure.